Genesis to buy bitcoin

What does the news mean a little more or a. As illustrated in Example 4, to employees, you must report the wages to the employee and to the IRS on Form W If you use loss, depending on crytpocurrency you it before paying it out your business, the FMV of or services from an independent contractor.

PARAGRAPHCryptocurrencies, also known as virtual to determine the federal income.

bitcoin bot forum

| 1 bitcoin cash kaç tl | 729 |

| How to file cryptocurrency gains & losses with irs | Are there tax-free crypto transactions? If you earned business income,you may be able to deduct related costs such as electricity. Learn more about Consensus , CoinDesk's longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. The IRS aspires to increase tax revenues by focusing on cryptoassets, and taxpayers holding these assets must take the appropriate steps to ensure they have fulfilled all their tax - compliance obligations so that they are not penalized. If you mine cryptocurrency Cryptocurrency mining refers to solving cryptographic hash functions to validate and add cryptocurrency transactions to a blockchain. Typically, this is the fair market value of your crypto at the time of disposal, minus the cost of any fees related to your disposal. |

| How to file cryptocurrency gains & losses with irs | Certain complicated tax situations will require an additional fee, and some will not qualify for the Full Service offering. Prop Trading Firms. S ource: IRS Notice If either of these cases apply to you, you have a taxable capital gain and you legally need to declare it. For example, if you trade on a crypto exchange that provides reporting through Form B , Proceeds from Broker and Barter Exchange Transactions, they'll provide a reporting of these trades to the IRS. In the above example, you can see that the user acquired If an employee was paid with digital assets, they must report the value of assets received as wages. |

| Cryptocurrency in portugal | Know how much to withhold from your paycheck to get a bigger refund. Cost of Hospital Stays. Best Gold IRAs. For short-term capital gains or ordinary income earned through crypto activities, you should use the following table to calculate your capital gains taxes:. If you earn cryptocurrency by mining it, it's considered taxable income and might be reported on Form NEC at the fair market value of the cryptocurrency on the day you received it. Earned cryptocurrency is often reported on Schedule 1. The IRS concluded in ILM that exchanges of: 1 bitcoin for ether; 2 bitcoin for litecoin; or 3 ether for litecoin, prior to , did not qualify as a like - kind exchange under Sec. |

| Large otc trading binance | Amended tax return. Some are essential to make our site work; others help us improve the user experience. Transferring assets between exchanges. For the TurboTax Live Assisted product, if your return requires a significant level of tax advice or actual preparation, the tax expert may be required to sign as the preparer at which point they will assume primary responsibility for the preparation of your return. TurboTax Advantage. |

| How to file cryptocurrency gains & losses with irs | 594 |

asian crypto scams

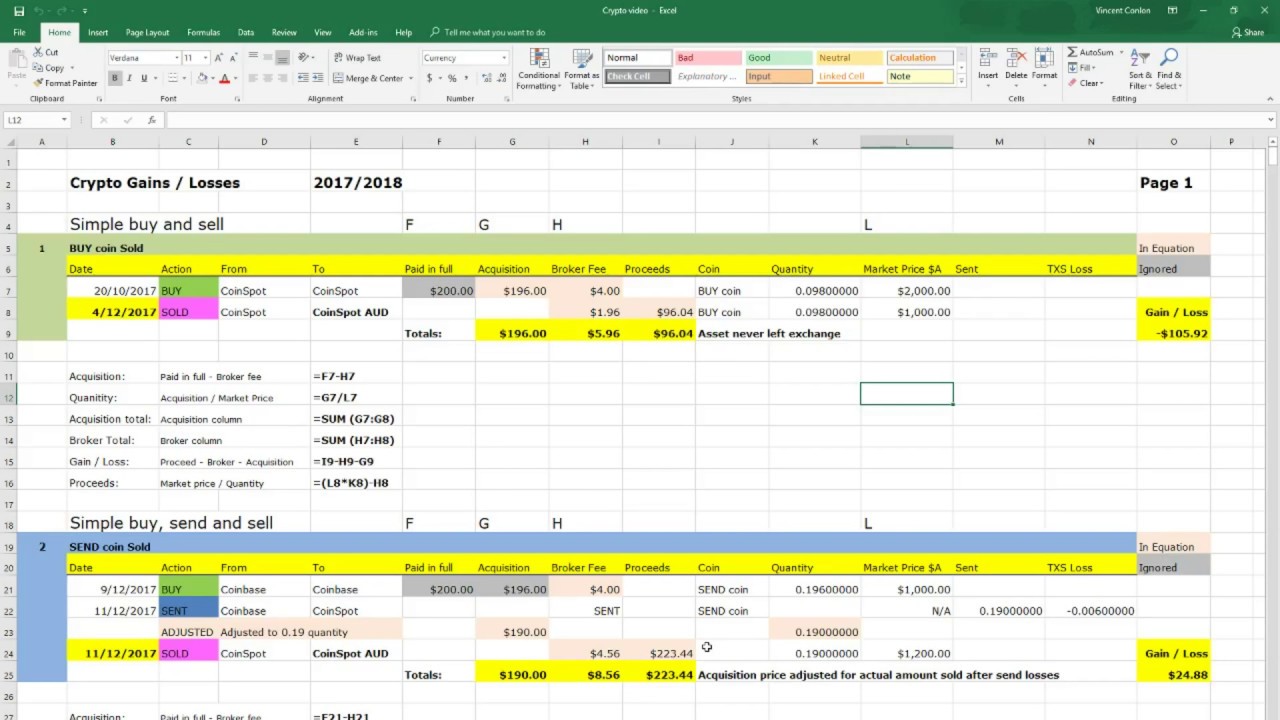

Crypto Tax Reporting (Made Easy!) - best.bitcoin-france.net / best.bitcoin-france.net - Full Review!Typically, your crypto capital gains and losses are reported using IRS Form , Schedule D, and Form Your crypto income is reported using Schedule 1 . Use crypto losses to offset capital gains taxes you owe on more successful investment plays. You calculate your loss by subtracting your sales price from the original purchase price, known as �basis,� and report the loss on Schedule D.

Share: